Rollover Manager

Use the Rollover Manager to roll over income and property tax returns from last year, or to roll over sales tax returns from last quarter or last month.

If last year's version of ATX is not installed on the system (or not installed in the default location), you'll receive a message asking you to browse for the correct system folder.

The following data is transferred into the current year’s return:

- Names

- Payers for Forms 1099, and employer information for Forms W-2

- Depreciable assets

- Carry forward data from passive activity losses, capital losses, net operating losses, and contributions

- Names of business, rental, and farm properties

- Names of partnerships, S-corporations, and trusts or estates from which the taxpayer received a K-1 in the previous year

- Names of companies, shareholders, partners, and beneficiaries for business returns

- Data from customized master forms

- User-entered notes on individual cells in forms (only those notes marked Permanent will be rolled over)

- Itemized, text, and custom lists

- Custom List templates (User-specific. Only users who create them can roll them over.)

- Client Letters (attached to a return)

- Global Client Letter Templates (including customizations)

- Print Packets (User-specific. Only users who create them can roll them over.)

- Asset Classifications

- Custom Reports

Custom lists are rolled with returns that are rolled over from last month or last quarter.

Client Letters with associated obsolete forms in 2016 do not roll over.

Payroll returns are not supported in ATX 2016. If you have not yet installed the 2016 W2 and 1099 or Payroll Compliance software, see W2-1099 or Payroll Compliance.

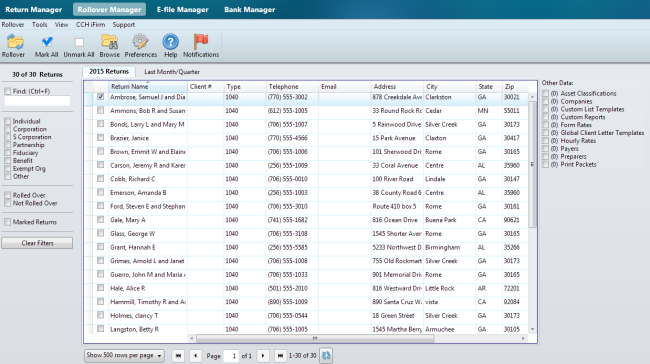

To open the Rollover Manager, click the Rollover Manager tab at the top of the application.

Rollover Manager

Rollover Manager Tabs

Rollover Manager has two views – 2015 Returns Tab and Last Month/Quarter Tab. To select a view, click the desired tab above the list of returns.

2015 Returns Tab

When you roll over last year's return, the program retrieves selected data from the last year's return and uses this information to populate the corresponding forms for the current year.

Last Month/Quarter Tab

The Last Month/Quarter Tab lists your clients returns from a prior month or quarter available for rollover.

How To Topics:

- Rollover Other Data

- Rollover Returns from Last Year

- Rollover Returns from Last Month/Quarter

- Export Existing Contacts to CCH iFirm

See Also: